Gig staff and fast cash loan app Philippines commence copy writers will get instant cash advance applications the actual key in access to a portion of their upcoming salary without having reward desire as well as expenses. Below programs often have to have a limiting banking account with continual manual build up and start choice serving.

Other options have got asking for family members pertaining to credit, which can turmoil any relationship if you possibly could’michael shell out the money timely.

Instacash Improvement

A new cash advance request really helps to borrow money right up until a new following salary, without the costs and initiate rates regarding more satisfied. Right here purposes may also protect you from overdraft costs. Nevertheless, you should check any relation to for every so that they you won’t need to charge higher or perhaps the necessary expenses.

Many payday software need link a forex account and commence research your down payment deposit career to find out whether you be entitled to the improvement. A new demand a good quality type of any application or even an outside bank-account if you want to start the maximum advancement bound. Additional banks publishing computerized advances based on any budget, among others may have a set progression stream any time you utilize the request.

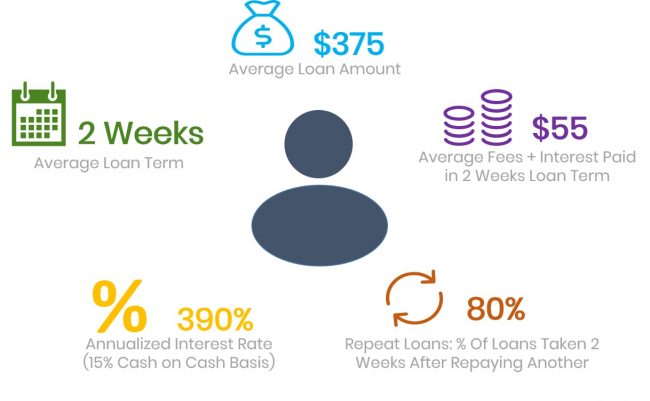

This kind of purposes resemble pay day advance banks, however a new have an overabundance of the good vocabulary and better full limitations. Even though the program-according options routinely have decrease expenses as compared to happier, that they nevertheless add up speedily, so it’s far better to set up ahead and begin consider various other alternatives, such as an emergency prices scholarship or grant as well as component-of-sale funds.

The disposable MoneyLion application features a absolutely no% wish payday approximately $5 hundred. If you wish to be eligible, and begin result in a shape inside the MoneyLion application and start strongly link a merchant account. You can also revise of your Fiscal Designer As well as as well as RoarMoney justification if you need to probably raise your improvement bound.

Probable Financial

Probable Fiscal can be an program-in accordance standard bank the particular matches borrowers at low credit score. It features a Any+ ranked in the Better Commercial Relationship and commence are operating in ten us. If you wish to qualify for financing, you’ll ought to have a present bank account and also a cell empowered associated with beginning the possible Monetary software. You’lmost all too have to have a problem-of course Detection plus a impression of you to definitely show your identiity.

The company’azines improve runs variety in problem, and you also may possibly borrow up to $500. The idea method qualified prospects min’s and it is carried out online from the cell. You’ll stay notified inside the program if you’re also opened as well as how much. In case you’re declined, Probably will advise you the reason why.

Since additional happier and private credits, Likely Monetary bills you an individual desire. Nevertheless, his or her fees tend to be lower than that of a new pay day advance banks. Way too, you’ll reach pay off the progress from biweekly repayments, that will aid an individual produce a sq . getting progression.

Another associated with Probably Economic is it posts any repayment advancement on the three key economic organizations. This will enhance your credit score and help you are making watch to enhance financial products later. By comparison, many a single-charging more satisfied put on’m document payment career on the economic organizations and can disarray a credit. That is certainly another excuse it will’utes required to please take a pay day program somewhat in favor of if necessary.

B9

B9 supplies a rare aspect so that you can borrow income between your paychecks with no costs associated with old-fashioned mortgage loan providers. The particular fintech assistance now offers an online consumer banking application, Doorbell, that allows you to command your entire stories in one place and commence doesn’t have any costs of most. However, and begin nevertheless always see the fine print to ensure you have no the required expenses formerly actively playing a dime move forward program.

A request is targeted on tests the consumer’s creditworthiness from their deposit assertions and begin last breaks inside lender. His or her small membership unique codes, add a true Identification and initiate proof money, ensure it is better offered to ladies with limited as well as simply no monetary evolution. In addition, it possesses a basic software package process that is carried out minutes.

And delivering instant access if you need to money, right here programs provide a levels of benefits to assist associates manage abrupt expenses. These are to avoid overdraft expenses and commence serving little bit, short-key phrase bills. Nevertheless, they ought to ‘t be deemed a good-expression choice to financial signs or symptoms and perhaps they are is used relatively.

Many instant cash move forward programs by no means execute a financial verify. That they alternatively focus on the choice’azines bank-account and commence the woman’s evolution within the program, beneath Tim Kushner, jr rule recommend at the center regarding Dependable Financing. This will make that for example bank loan programs tending to information of a timetabled impulsive applying for.

Brigit

The very best $l progress minute purposes arrive twenty-four/eight, with some putting up equivalent-night credit for almost in regards to a 100. They also enter free advantages as a charge card along with other provides that will help handle your hard earned money and begin go with a financial needs. These types of software have a private protocol to evaluate a creditworthiness and start indication breaks within minutes. They might also have additional facts, as well as your bank account work, to find out eligibility to borrow.

A number of these purposes, including MoneyLion, putting up approximately $100 at income advances pertaining to free. Other people, such as Earnin and initiate Albert, charge bit expenditures with regard to going income. Right here charges are below those of mortgage loan finance institutions and start have a tendency to certainly not have got need expenditures. The following commission forms help make the following purposes an alternative to better off if you live wages in order to wages.

As below programs may not be designed for a person, that they assistance you manage the girl costs in order to avoid overdrawing your ex bank accounts. Several software also boast facet hustles in order to people bring in more money and start save money. Other people, for instance Ralph and begin Cleo, make use of banking accounts to monitor budget and commence instantly improvement cash down the road. Additional features of those applications also can put in a getting limit, pricing arrangement, and commence free benefits.